Here is a very simple problem. Assume you want to build a right triangle of known base (10) and height (3) dimension. However, the sigma tolerance of these dimensions are 1% of its value. Your goal is to find the variability that you will obtain for the dimension of the hypotenuse and the largest of the two complementary angles. It is straight forward to do some simple math to figure out the nominal value for the two variables of interest. This is shown in the figure below:

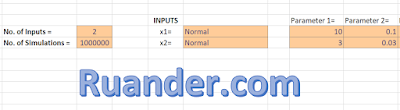

Note that the variables of interest are not linear with respect to the known variables. Therefore, it is not possible to simply add the variances of the two known dimensions. It is possible to use the principles of propagation of uncertainty to propagate the known variation through the non-linear equations. This exercise will be left to the reader. Here, I will show how you can quickly use my Excel Monte Carlo Workbook to solve this problem. First, download the free version of this workbook or if you wish, you can also purchase the non free version here. Set up the problem with 2 input variables of normal distribution with the given mean and sigma values. The inputs will look like this:

Finally, simply compute the average and standard deviation for the variables of interest. The results are the following:

As mentioned earlier, if you follow the principles of uncertainty propagation using partial derivatives, you will arrive at this same result (Rule No. 5 here). This is shown in the table above under the Analytical column. Using the Monte Carlo Excel you can also visualize the distribution of these two variables.

Since business and finance are plagued by random variables, Monte Carlo simulations have a vast array of potential applications in these fields. They are used to estimate the probability of cost overruns in large projects and the likelihood that an asset price will move in a certain way. They are often used in physical and mathematical problems and are most useful when it is difficult or impossible to use other mathematical methods. Monte Carlo methods are mainly used in three distinct problem classes: optimization, numerical integration, and generating draws from probability distributions. Students find it a little tough to understand and I am sure they will find your post very beneficial in their Math study. Keep sharing such helpful Math content. For more information visit here

ReplyDelete"Mont Carlo" is situated on an escarpment at the base of the Maritime Alps along the French Riviera.

ReplyDeleteClick Here https://actionairduct.net/ for Air Duct Cleaning Denver to get more details.