As we journey through the maze of financial literacy, one lesson stands out: the art of investing. Picture this – you've mastered the art of saving pennies and living within your means, but what about putting those hard-earned dollars to work for you? That's where investing steps into the spotlight.

Let's rewind a bit. Growing up, I was all about pinching pennies and stashing cash in my piggy bank. But the world of investing? It seemed like a distant galaxy, reserved for the elite with overflowing bank accounts. Little did I know, the key ingredients for investing weren't just heaps of cash – they were money and time.

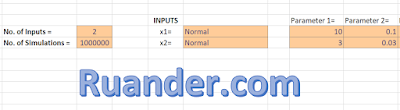

Now, here's the scoop: while you might not have stacks of cash lying around, you've got something even more valuable – time. Yep, time is your secret weapon in the world of investing. Starting early means your money has more time to grow and flourish, like planting seeds in a garden and watching them sprout into mighty oak trees. Here are some charts showing why starting early is important.

But hold up – there used to be a catch. Remember those pesky commissions? Yeah, they were like the gatekeepers to the investing world, demanding hefty tolls for each trade. Imagine trying to invest $10 but getting slapped with a $5 fee – talk about a buzzkill! But fear not, my friends, because the tides have turned. Commission-free investing is now the norm, thanks to platforms like Robinhood, Fidelity, and E*TRADE among many others.

And that's not all – say hello to fractional shares, the game-changer for budding investors everywhere! Got your eye on a pricey stock or ETF but only have a few bucks to spare? No problemo! With fractional shares, you can own a piece of the pie without breaking the bank. It's like buying a slice of your favorite pizza instead of the whole pie – affordable and oh-so-satisfying.

Now, let's talk about the elephant in the room – market knowledge. Sure, you might not have time to pore over financial reports and dissect market trends. But guess what? That's totally okay! You don't need to be a Wall Street wizard to make savvy investment decisions. Instead, focus on low-cost, diversified options like index funds and ETFs. They're like the Swiss Army knives of investing – versatile, reliable, and beginner-friendly. Take a look at VTI, great place to start.

In a nutshell, there's never been a better time to dip your toes into the world of investing, especially for young bucks. Time is on our side, and with just a few bucks, we can kickstart our investment journey. So go ahead, take the plunge – whether it's $1 or $100, the world of investing is yours for the taking. And the best part? You can set it and forget it, letting your money work its magic while you focus on the fun stuff. Cheers to a bright financial future!